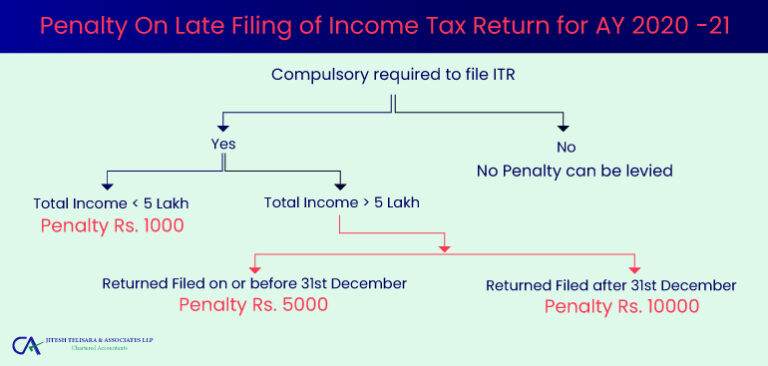

Mortgage Income tax Benefit – Ways to get Taxation Advantages on your own Home loan

Getting a house is actually the individual's dream. To help you remind owners to find a property, the federal government brings some tax positives on the mortgage within the Income tax Act from 1961 (the amount of money Tax Act). It's important to consider all mortgage tax pros as you can help you save a good deal of your taxation money.

Home financing comprises both dominant repayment and attract payments. Tax write-offs will be availed not as much as both of these categories less than Point 80C and you may Area 24(b) of your Income tax Act respectively.

Taxation write-offs into the dominating installment Under Area 80C

Lower than point 80(c) of your Income tax Work, income tax deduction of a max number of up to Rs 1.5 lakh might be availed for every financial 12 months for the principal repayment portion of the EMI. This deduction is only able to getting availed adopting the build of the domestic house house is complete. Note: if the home is offered within 5 years on avoid of your monetary seasons where arms of such house is obtained, this work for could be stopped. .

Tax Deduction to possess stamp obligations and you will membership charges Around Part 80C

Income tax deduction less than section 80(c) of your Tax Work will likely be stated to own stamp obligations and you can membership fees as well but it need to be within the full limitation out of Rs one.5 lakh used on dominant cost.